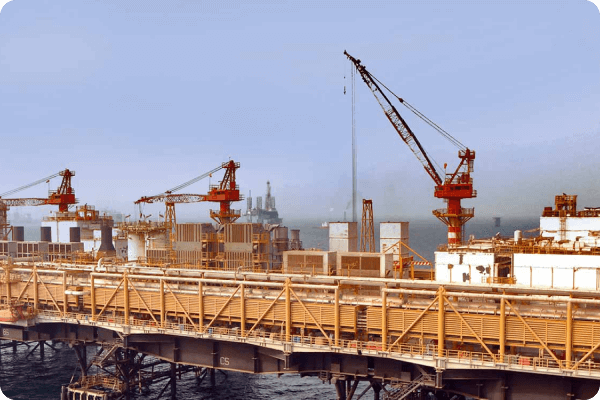

Company Formation in

Abu Dhabi Offshore

Setup your Abu Dhabi Offshore Company in a Quick, Easy and Effective manner with Connect Middle East.

Choose C-UAE for Abu Dhabi Offshore company setup. Our expertise in offshore company formation in Abu Dhabi ensures a smooth process, making your offshore venture efficient and successful.

Schedule a Consultation Call with Our Expert

Let Our Experts help you setup business in Middle East

Benefits of Abu Dhabi Offshore

Business Setup

Businesses can establish an offshore corporation in Abu Dhabi with the minimum criteria and greatest benefits. Some of the main benefits of the Abu Dhabi Offshore Business Setup are listed below:

- Foreign investors can have 100% ownership of the company

- Total repatriation of capital and profits

- 100% custom duties exemption

- There’s no income and personal tax

- You get the chance to carry out multiple business activities

- Offshore companies in Abu Dhabi don’t need a business license

- You have many choices for opening a multi-currency bank account

- It’s not mandatory to rent a physical office space

- Business-friendly environment

- Offshore companies have high level of confidentiality since it’s not mandatory to provide details

- Access to international markets to conduct international trading

- An offshore company provides financial stability and flexibility to conduct business

- It allows to have multiple investors

Type of Business Setup Options in Abu Dhabi Offshore

Special Purpose Company

Connect ME will help you establish special purpose company in Abu Dhabi offshore.

Branch office

Connect ME will help you establish Branch Office in Abu Dhabi offshore.

Representative Office

Connect ME will help you establish representative office in Abu Dhabi offshore.

Offshore Company

Connect ME will help you establish offshore company in Abu Dhabi offshore.

Company Formation in Abu Dhabi

Required Documents for Abu Dhabi Offshore Business Setup

To start your Business in Abu Dhabi Offshore you must have the valid and mandatory documentation. Make sure to gather everything you need so you don’t have to face any delays on your application due to missing or incorrect documents.

Here’s what you need to establish an Abu Dhabi Offshore Business:

- Copy of each shareholder’s passport

- Passport size photo in color with white background

- Business plan.

- Company Application Form.

- Proof of address.

- MOA (notarized).

- Passport copy of the designated manager

- Licenses and permits.

Schedule a Consultation Call with Our Expert

Let Our Experts help you setup business in Middle East

Why Choose Us

Connect Middle East is your local partner, which will help you in establishing a company in Abu Dhabi Offshore where it needs a thorough grasp of the legal and company formation processes. Acquiring our services means that your business setup in Abu Dhabi Offshore will be hassle free.

Select C-UAE for your Abu Dhabi Offshore company setup. Our expertise in offshore company formation in Abu Dhabi ensures a streamlined process. Benefit from our in-depth knowledge, local insights, and efficient services. Trust us to navigate the intricacies of offshore business in Abu Dhabi, allowing you to take advantage of the region’s tax benefits and business-friendly environment. Make C-UAE your partner in realizing your offshore business aspirations in this strategic and thriving jurisdiction.

FAQ's

Know more about the frequently asked questions

- Accounting and creating financial statements.

- Registration for VAT and adherence.

- HR and payroll services.

- Tax compliance and preparation for both businesses and individuals.

- Services for auditing and assurance.

- Services for business registration and licensing.

- Dubai UAE has a 5% standard VAT rate.

- A current Emirates ID or passport for each business owner.

- A business license that is still in effect.

- Information about the business’s operations and revenue.

- The deadline for submitting VAT returns is the last day of the month following the quarter in which they are due the conclusion of a quarter.

- Fines, penalties, and even criminal prosecution may be imposed for violating VAT requirements.

- International Financial Reporting Standards are the accounting standards used in Dubai, United Arab Emirates (IFRS).

- In Dubai, United Arab Emirates, an auditor is in charge of independently confirming the completeness and accuracy of a company’s financial statements as well as the observance of accounting rules.

- In order to start a business in Dubai, United Arab Emirates, you must choose a legal structure, get the relevant licenses and permissions, and register the firm with the appropriate authorities.

Do you have more questions?

Lorem ipsum dolor sit amet, consectetur adipiscing elit.