As the UAE becomes a bigger and more attractive hub for business people, new businesses grow every day in Dubai. But even though this city can be the most advantageous location for a company, several requirements shall be fulfilled first. For example, completing the TRN verification process in Dubai is essential for any company that conducts business in the emirate.

In this article, you will learn all you should know about the TRN (Tax Registration Number) and its verification procedure. And here you can also find the reasons why having this element is important for a company in the UAE. Besides, you will also find useful information and tips related to the process to obtain a TRN for your company.

Why is TRN Verification Important in Dubai?

As we previously mentioned, all companies operating in Dubai or the UAE must obtain a Tax Registration Number or TRN. But before obtaining it, it will be necessary to learn about its main characteristics, function, and importance for your business. And its main characteristic is that this unique number is issued by the FTA or Federal Tax Authority to VAT-registered businesses.

Now, as for its function, this unique 15-digit code is like an ID for companies and individuals for tracking taxes. On the other hand, you can obtain your TRN by registering for the VAT (Value Added Tax) in the UAE. Therefore, if your company charges VAT to customers, it is necessary to have this number. Or else there will be fines and other penalties for your business.

Lastly, it is also worth mentioning the importance of TRN verification in Dubai and the consequences of not having a valid TRN. Once a company becomes a registrant in this country, it is mandatory for it to pay taxes to the government. And if that company has a valid TRN, it will be easier for the authorities to keep track of the company’s transactions. As you may know, companies must collect 5 percent of VAT from their customers and send it to the authorities.

However, some businesses may try to take advantage of this and collect VAT from customers without being registered with the FTA or having a valid TRN. In that case, these businesses do not transfer that money to the government but keep it, which is illegal. As a result, they can instantly get fines and penalties for this reason. Of course, unregistered companies are not allowed to collect VAT. Therefore, you must obtain a valid TRN for your company if it is eligible for collecting VAT in the UAE.

How to Obtain a TRN?

Obtaining your Tax Registration Number is a straightforward process that you can easily complete online on the FTA’s official website. As a matter of fact, the process consists of some simple steps you must follow, which you can find below:

- Before obtaining a TRN for your company, you must verify that your business is eligible for collecting VAT in the UAE. And if it is eligible, you have to register for VAT on the FTA’s official website. After that, you will be able to start the process to obtain your TRN.

- Once you have registered your account on that particular website, you can start the process to get your unique TRN. And this procedure will require you to submit a number of documents that we will mention below.

- And right after submitting your application form and documents, the authorities will review them and issue your TRN certificate. Then, you will receive your unique 15-digit code that will identify your business and allow you to collect VAT.

Furthermore, once you obtain your TRN, it is necessary to complete the TRN verification process in Dubai. This way, you can make sure and prove that you have a valid TRN. And just like the previous process, you can also carry out this one through the FTA’s official website. There you will find a special tool that verifies the existence of Tax Registration Numbers that were given to businesses.

Below, you will be able to find further information about the steps you must follow during the application process for getting your TRN. Plus, you will also find a list of all the documents that you must submit to the authorities during this procedure. Lastly, you will learn how to verify your TRN by using the online tool provided by the FTA.

Documents Required for TRN Verification

It is necessary to provide a number of documents in order to carry out the TRN verification process in Dubai. For example, among the main ones, you will find the company’s MOA (Memorandum of Association) and trade license. Moreover, it will be essential to provide import and/or export declarations as well, along with other documents such as:

- Your company’s bank account details.

- The Emirates IDs of the shareholder and/or the manager along with copies of their passports.

- Your company’s turnover declaration letter.

- Contact details and address of your company.

- Your company’s income statement from last year and bank details.

- And sample invoices from your customers and suppliers.

Apart from the documents you need to complete the process to obtain your TRN, other documents are necessary for other procedures. For instance, as per the UAE VAT laws, there is a requirement for all companies registered for VAT with a TRN. And that requirement is that these companies must mention their Tax Registration Number on every invoice that they issue.

As you may already know, the TRN of a company is a 15-digit number that identifies that particular business. Therefore, in order to differentiate it from other businesses, the importance of TRN verification in Dubai also relies on mentioning it in tax-related documents. For example, every tax invoice, VAT return, tax credit note, and other similar documents requires you to specify your TRN. Furthermore, keep in mind that a taxable person who has TRN can only charge VAT on invoices.

The TRN Verification Process

Now that you know about the required documents for the TRN verification process in Dubai, you should learn about the process. Firstly, you will be required to complete the registration process for the Tax Registration Number. Then, once you have completed the steps we will explain below, you will need to prepare and submit all necessary documents.

After getting these steps done, you will go through the submission and review process. Then, the last stage of the TRN verification process in Dubai, which consists of the issuance of your TRN Certificate. On the other hand, as a suggestion, business owners should get professional advice from specialists before starting this essential process.

But before starting the registration process for TRN, you should be aware of the eligibility criteria and voluntary/mandatory registration. In the first place, the national laws state that all businesses operating in the country must comply with this regulation. However, for a business to be eligible for VAT registration and TRN, it must fulfill some revenue requirements, including:

- In the case of voluntary registration: the company must comply with a voluntary threshold for VAT and TRN registration, which is AED 187,500. Furthermore, the company can choose to register for VAT if its revenue is between AED 187,000 and AED 375,000. However, if the company’s revenue is lower than AED 187,500, it will not need to register for VAT.

- In the case of mandatory registration: the process for TRN verification online in Dubai and registration in the UAE also includes a mandatory threshold that consists of AED 375,000 approximately. In other words, the company must mandatorily register for VAT and TRN if its revenue is expected to exceed this amount in the next month or exceeded in the past 12 months. Otherwise, there will be hefty penalties/fines for not registering.

Registration for TRN

Previously, we explained the eligibility criteria you must be aware of. And if your company is eligible, you should consider starting your registration process. Now, to register and carry out the process for TRN verification online in Dubai, you need to follow these steps:

- Firstly, you have to visit the FTA website and click on the sign-up option. Then, fill in the form to sign up on the next tab.

- Secondly, you will receive an email to your address to start your registration after filling in the previous form. Make sure to confirm your email so you can log in to your e-service account and access secure TRN verification services in Dubai.

- Once you log in to your account, you have to click on the register for VAT option in your dashboard. After that, make sure to navigate the “getting started” guide.

- Lastly, you must click on “Confirm you have read the getting started guide” and then click on “Proceed”. You will be redirected to a new tab that consists of a form. This form contains 8 sections that you must fill out in order to apply for your TRN number.

Preparing Documents

Right after submitting your application for your TRN registration, you will be required to provide the documents we previously mentioned. Here is the full list of the necessary documents for the registration and TRN verification process in Dubai:

- Your company’s MOA (Memorandum of Association).

- A valid trade license.

- Import and/or export declarations

- Your company’s bank account details.

- The Emirates IDs of the shareholder and/or the manager along with copies of their passports.

- Your company’s turnover declaration letter.

- Contact details and address of your company.

- Your company’s income statement from last year and bank details.

- And sample invoices from your customers and suppliers.

Before submitting all these documents, you need to check each of them and make sure there are no errors. Besides, by checking your documents prior to sending you also make sure to provide the right information.

When carrying out this process, it is recommendable seeking professional advice from specialists in order to complete every step correctly. In fact, getting services from specialists is one of the best TRN verification methods in Dubai you can opt for.

Submission and Review

Once you have submitted your application form and documents correctly, you must send them to the pertinent authorities in Dubai. And since it is an online process, you can do it by simply clicking on “submit for approval”. Then, the authorities will receive your information, review it, and approve it if everything is in order.

Make sure to provide accurate information about your business before sending your application. This way, there will be no delays during the issuance process of your TRN certificate. Therefore, most business owners like you need to obtain services from a tax specialist in order to avoid mistakes.

Issuance of TRN Certificate

At this stage of the TRN verification process in Dubai, all you need to do is wait for the results. After completing all the previously mentioned steps, the authorities in the emirate will issue your TRN certificate. Plus, you will be able to check your TRN validity by following these steps:

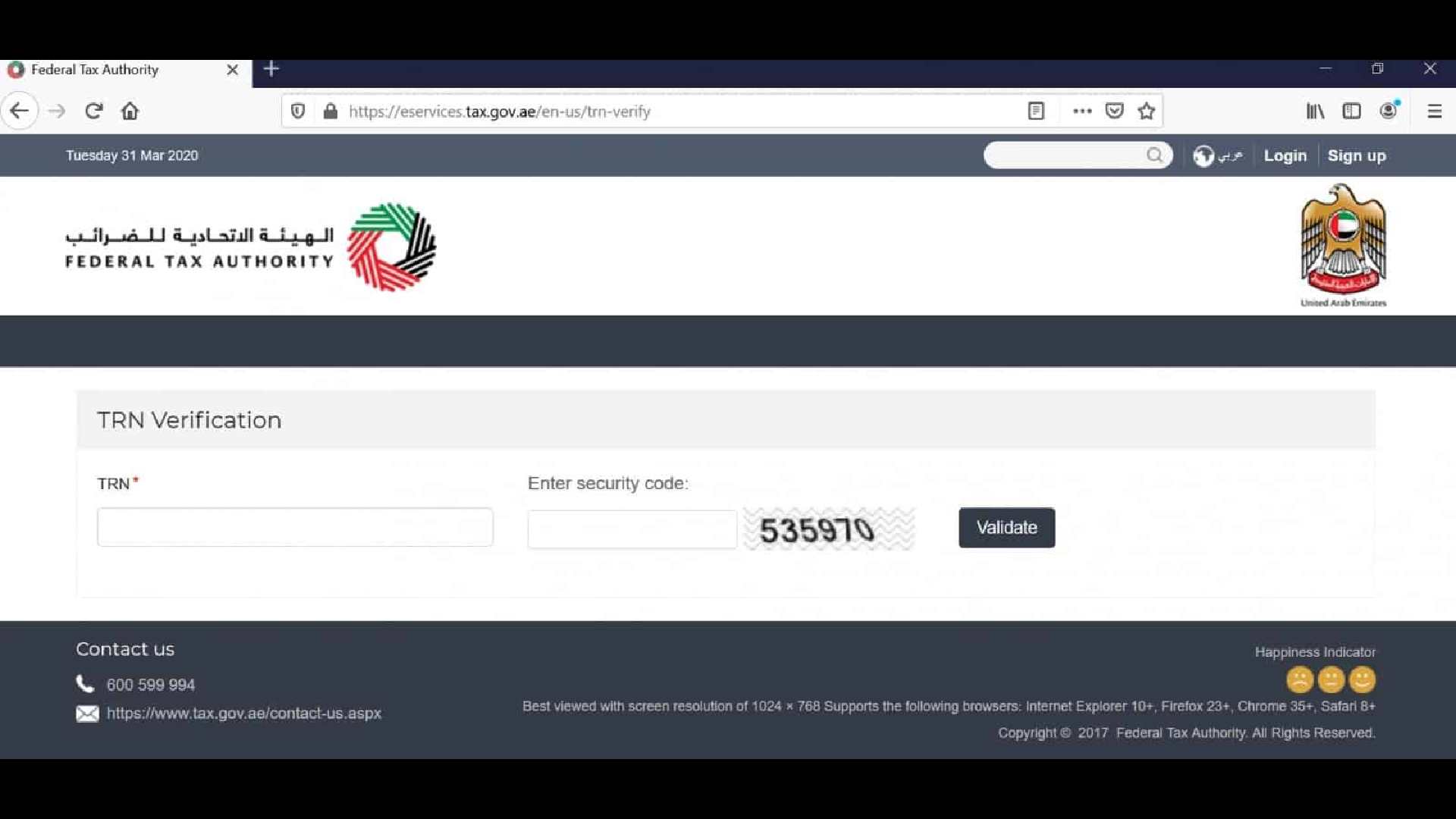

- Firstly, visit FTA’s official website and search for the TRN verification tool.

- Secondly, enter all 15 digits of your TRN in the field labeled “TRN”. Do not forget to solve the captcha code.

- Thirdly, click on the validate option once you have filled both required fields.

- Lastly, the platform will provide you with the details of the registrant to whom that TRN belongs. However, keep in mind that this will only appear if the TRN is valid. Otherwise, there will be no results.

As you may know by now, applying for a TRN and completing the TRN verification process in Dubai is essential. This procedure will save your company from losing money or getting banned. Nonetheless, it is preferable to complete these processes with the help of a local specialist.

And that is when Connect Services Middle East can help you by providing you with the advice and services you need. Therefore, do not hesitate and contact us by calling us at +971 43 316 688 or sending an email to [email protected].